Part II was getting too long to read, so I had to split. So I develope part III.

Disclaimer: The views expressed are solely mine and are based on my research and expertise. I really appreciate comments, corrections, and additional information. If you prefer not to read the entire article, feel free to skip to the “Wrapping Up” section at the end.

I want to take an in-depth look at some digital money and Central Bank Digital Currency (CBDC) projects around the world, diving into the nuances of the blockchain technology that could potentially be the driving force behind a nation’s digital currency. Examining the features, benefits, and potential challenges of implementing this technology at a national level.

Drex for gringos — Part I covers Brazil’s introduction of DREX, Brazil’s CBDC, a new programmable version of the Brazilian Real, bringing new improvements to the financial system. We discussed its significance, how it could streamline transactions, and its potential impact on the global economy.

Part II covers a bit of DREX’s origins and history, explaining how the pilot is working and detailing some information about the use cases and solutions being tested.

Programmable Money

As we move through the digital age, we find ourselves navigating the inevitable decline of traditional, physical methods of payment, like cash and checks. So, there’s this huge and always growing bunch of digital and/or programmable money options out there, all trying to get us to like them.

These modern methods, which range from various forms of online banking and digital wallets to the somewhat mysterious world of cryptocurrencies, present us with a wealth of options to choose from. Each one comes with its own unique benefits and drawbacks, shaping a complex landscape of digital transactions that the masses are just beginning to understand.

We’ve realized that they are more than just a novel way to transfer funds. They represent a revolutionary shift in our financial systems, offering unprecedented levels of efficiency, security, and accessibility. Yet, they also bring forth new challenges and questions that we must address. Among these, one question stands out due to its potential to define our financial future:

What type of programmable money do we envision as the primary means of transaction in our future?

This is more than just a speculative debate, it is a call to action for us to explore, understand, and shape the digital financial landscape of tomorrow (or today’s). It is a challenge that invites us to consider the possibilities, weigh the pros and cons, and make informed decisions about the adoption and use of digital currencies. We are not just passive observers but active participants in the evolution of our financial systems.

While embarking on this journey, we must remember that there is no one-size-fits-all answer. The “right” type of programmable money will depend on a variety of factors, including our financial needs, technological capabilities, regulatory frameworks, and societal values. It will require us to strike a delicate balance between innovation and stability, freedom and security, inclusivity and integrity.

In the end, our collective decision will shape not only the way we transact but also the way we live, work, and interact with each other in the digital age. It is an exciting and daunting task, but one that we are ready and capable of undertaking. Let’s embrace this opportunity, confident in our ability to create a financial future that is fair, efficient, and resilient.

Sovereign vs non-sovereign money

You know how we kind of just assume money is as much a part of our country as say, laws or the police? Well, there is another way to look at it. Thanks to computer code, we can now have digital money, like cryptocurrencies, that does not have to answer to any country.

Take bitcoin for example. It is trying to do its own thing, separate from any nation. Then you have got these new things called “stablecoins” that are not even regulated yet. If we let these cryptocurrencies and stablecoins do their thing without any rules, they might take over our regular money. This could mess with a country’s ability to control its own fate and could even shake up our financial stability.

So, here is the deal. Right now, each regulated institution has its own proprietary database for its own currencies. It is like every institution is its own little island of data, keeping track of customers and their deposits.

The way traditional payment systems work is like sending messages between these data islands, and it involves a whole bunch of tricky reconciliation and settlement processes. This leads to a lot of friction and delays, which is a real bummer.

Cryptocurrencies and stablecoins leverage a technology commonly known as a shared ledger, which has the capability to be programmable or “pseudo” Turing complete. The term “pseudo” Turing complete means that while the system supports a wide range of computations in theory, practical constraints on resources like computation and storage introduce limits to what can be executed in practice.

As noted by Andreas Antonopoulos in “Mastering Ethereum”, while Ethereum and other blockchains support a language that allows for Turing completeness, the practical limitations imposed by block size mean that they are not truly Turing complete (pseudo Turing complete).

These limitations are primarily related to block size and the gas system, which is used to limit the amount of computational work that can be done in a single block to prevent spam and ensure network efficiency. The gas system in Ethereum imposes a cost on every operation executed on the network. Complex operations or programs that require a lot of computational power can become prohibitively expensive due to the gas cost. This limits the complexity of the smart contracts that can be run on the Ethereum blockchain, making it “pseudo Turing complete.”

Despite this, advocates of blockchain technology, myself included, consider it a groundbreaking innovation with the potential to revolutionize the financial services industry. The programmability of these shared ledgers, even within their constraints, opens up a realm of possibilities for automating and securing financial transactions in ways previously not possible.

Ok, what does Turing Complete mean?

Turing completeness comes from the idea of a Turing machine. A system is considered Turing complete if it can do these main tasks:

Sequence: Follow a set of steps in the order given.

Conditionals: Choose different steps based on certain conditions.

Iteration: Repeat certain steps many times.

Store Data: Keep results that are needed later in memory.

If a system can do all these, it can do any calculation a regular computer can, though it might be slower or need more memory. The end result, however, would be the same.

But continuing…

So, if this whole shared ledger thing is better than the old-school financial infrastructure, we can put sovereign currencies on them without messing with their legal requirements, right? The legal part stays the same, no matter what tech you are using. It does not matter if it is scribbled on paper, in an old database, or on a blockchain. It is all the same to us. After all, legal came way before the computer code.

CBDC taxonomy

A CBDC is basically a digital makeover of a country’s national currency. It’s all official and backed by the central bank — think of it like a digital dollar, euro, or yen. Sure, central banks have been dishing out digital money to financial institutions for ages (like the digital dough banks have sitting at the central bank), but a CBDC? That is something fresh for us regular folks and businesses to use, not just the banks.

In the past, central banks allowed a wide range of organizations to hold accounts with them, but over time they’ve limited this mostly to banks. Recently, some non-bank financial entities, like those that help with trading securities (central counterparties), have been given access mainly to help keep the financial system stable. Some central banks also let other types of financial players use their money-absorbing tools, which are ways to manage the amount of money in the economy.

So, when we talk about CBDCs, we’re talking about a fresh type of central bank money designed for everyone to use digitally, not just the existing digital money that banks use among themselves. This new form would be used for daily transactions and savings. To gain a deeper understanding, we can refer to the 2018 publication by The Bank for International Settlements (BIS) titled “Central bank digital currencies”. You can download and read it from here.

The document introduces “the money flower”, a Venn-diagram that presents the taxonomy of money. This model focuses on combinations of four key properties: issuer (central bank or other), form (digital or physical), accessibility (widely or restricted) and technology (token- or account-based).

Money usually operates on one of two essential systems: token-based or account-based.

Cash, along with many digital currencies, leverages the token-based system, while reserve account balances and the majority of commercial bank money use the account-based system.

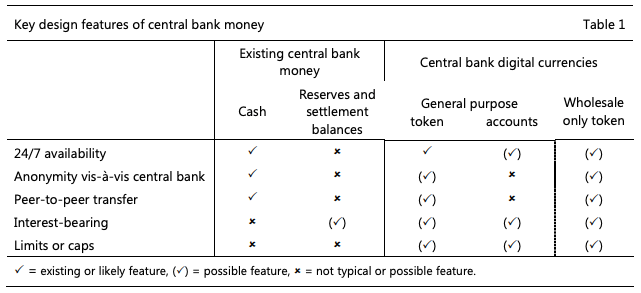

Beyond the primary four properties outlined above, there exists a myriad of other design features that will dictate the capacity of a CBDC to function as a reliable means of payment and a solid store of value. These strategic choices will undoubtedly shape the landscape of payments, influence monetary policy, and determine financial stability.

The most critical CBDC design alternatives recognized to date are highlighted in the table below:

Availability: currently, digital central bank money access is restricted to less than 24/7. CBDCs could potentially offer continuous availability or operate within specific hours. They could also exist permanently or for limited durations (e.g., intraday issuance and redemption).

Anonymity: token-based CBDC can offer various levels of anonymity, similar to private digital tokens. The balance between anonymity for the central bank and concerns about money laundering, terrorism financing, and privacy is a key societal decision.

Transfer mechanism: cash transfers occur peer-to-peer, while central bank deposits involve an intermediary. CBDCs could be transferred either peer-to-peer or via an intermediary like the central bank, a commercial bank, or a third party.

Interest-bearing: both token- and account-based CBDCs can technically bear interest. The CBDC interest rate can align with existing policy rates or differ to manage demand. Both non-interest and interest bearing accounts can be used for transactions. Paying interest would likely boost the appeal of an instrument that also serves as a store of value.

Limits or caps: quantitative restrictions on CBDC use or holdings can control undesirable effects or guide usage. For instance, these could steer CBDC towards retail rather than wholesale payments. Currently, non-anonymous account-based systems best accommodate these limits.

Back to taxonomy…

According to the money flower diagram, there are 3 main “types” of CBDCs:

- CB Account — General-use account-based CBDC: In this model, both institutions and individuals could maintain their money directly with the central bank in a unified account balance system. This type of CBDC could also facilitate retail payment transactions, akin to the Brazilian instant payment system, Pix.

- CB Digital Tokens — General Purpose-Based: In this model, both institutions and citizens could store their money directly with the central bank. They would control “virtual banknotes” in the form of tokens. A CBDC like this could be used for retail payments, providing an unprecedented degree of traceability in money flow. This is possible because the tokens can be identified similarly to the serial numbers on physical banknotes.

- CB Digital Tokens — Wholesale-only CBDC: In this model, the CBDC would be accessible only to institutions, with the central bank directly holding custody in the form of tokens. This approach would provide a higher degree of traceability and control over the institutional money flow.

In the context of wholesale markets, the primary assertion is that the use of wholesale CBDC (wCBDC) could make financial transaction settlement systems more efficient and secure. This efficiency relates to operational costs, collateral use, and liquidity.

The creation of a wholesale CBDC that works like traditional Central Bank reserves might make settlement between banks more efficient and help manage risk better.

If non-banks were to directly participate in the settlement process, the benefits could further increase. These benefits could include facilitating the use of new technologies for asset transfers, authentication, record-keeping, data management, and risk management.

Payments and securities transactions settled in CBDC, rather than through facilities managed by commercial banks or other service providers, could reduce counterparty credit and liquidity risks in the financial system. It could also aid central banks in monitoring financial activity.

CBDCs and blockchain

CBDCs are centered around enhancing one aspect of the sovereign currency system.

Central bank money, commercial bank money, and e-money issued by regulated non-banks make up the family of sovereign money as defined in this paper. Sovereign money is issued by public and regulated private institutions (banks and non-banks) under authorization by the nation state.

Blockchain networks provide a base platform for transforming financial systems in the context of a CBDC ecosystem. These networks are intricate and versatile, with layers of dynamics playing out at different scales and time periods. CBDCs can use tokens designed with specific goals in mind, which help link personal incentives with group objectives, thus encouraging a united financial ecosystem.

So, blockchain tech gives CBDC networks the tools they need to keep a tidy ledger, letting people make direct transactions with each other; and promoting good vibes for the network as a whole. Basically, we are talking about a top-notch setup that helps people work together economically without the fuss of old-school middlemen.

CBDCs on blockchain platforms can also serve as a regulatory framework for autonomous economic agents operating within a “trustless” network. The tokens within these networks not only facilitate transactions but also generate a comprehensive data set that captures all economic activity in real time.

This wealth of information can be harnessed using advances in network science and data science, allowing for the design and analysis of these economic systems through the lens of modern systems engineering best practices. This approach also ensures that CBDC ecosystems are robust, efficient, and capable of meeting the complex demands of contemporary financial landscapes.

It is ok if some people are not convinced that CBDCs need blockchain. No big deal.

Some Central Banks are more into tweaking things, than shaking them up, so CBDCs might just go their own way, separate from blockchain tech. Some digital money projects are leaning towards improving existing infrastructure rather than adopting blockchain technology.

But this does not dismiss the possible value of blockchain technology. It has benefits like transparency, security, and traceability. But these must be balanced against the central banks’ priorities such as financial stability, scalability, and monetary control.

Many experts believe that existing technology can be improved to meet current needs. Traditional systems are reliable, well-understood, and trusted by the public and institutions.

However, some believe that blockchain or DLT (Distributed Ledger Technology) could still be crucial to CBDC’s future. They argue that while existing systems can be improved, blockchain presents a new model that could more efficiently handle cross-border transactions and financial inclusion.

The debate on whether CBDCs can operate without blockchain technology is still ongoing. As CBDCs evolve, discussions around their underlying technologies will also develop. Each central bank will make decisions based on its unique situation and goals.

What is going on in the global CBDC scene?

Every CBDC project being developed in the world is as unique as the economy from which it originates. Each project has its own specific objectives and is built upon its own technical framework. They are tailored to reflect the individual needs and characteristics of their respective economies, incorporating various technological aspects to ensure their effectiveness and efficiency.

And just to give you a head start, I have picked out a few pilot and launched projects, some of which I consider more relevant than others:

Bank of China’s Digital Yuan, or e-CNY

One of the primary objectives of e-CNY is to significantly enhance the efficiency of retail transactions. This is done by providing a seamless and friction-free platform for payments, thereby transforming the retail landscape.

For the foil-hat crew: I will not explore conspiracy theories about controlling people’s behavior, minds, pockets etc. My goal here is to provide technical information and use case information. Please don’t cause any trouble, okay?

The e-CNY is also designed to foster financial inclusion by extending financial services to underserved populations and regions.

In terms of technology, it’s important to note that the e-CNY is not built on traditional blockchain or distributed ledger technology (DLT). Instead, it was developed with a custom-built system, specifically tailored for the unique characteristics of China’s economy. This bespoke technology (buzz word alert!) ensures that the e-CNY can support the country’s economic demands and operations. You can Google about it if you are interested but here is an interesting link about it.

The Eastern Caribbean Central Bank (ECCB)

ECCB has introduced a new currency system, DCash. This innovative system aims to secure, expedite, and make cost-effective transactions within its member states. At its core, DCash uses Bitt Inc.’s DLT technology. This solution enables real-time cross-border payments, representing a significant advancement in the payment system of the ECCB’s member states. As a result, users can enjoy a seamless and efficient transaction process too.

ECCB has issued a Request for Vendor Information (RFVI) to gather suggestions from vendors to guide the discovery process for the commercial deployment of its DCash retail CBDC technology solution. Specifically, the ECCB is looking for input from vendors that have “developed a retail CBDC solution or core components of such a solution that are deployment-ready”. In collaboration with its technology partner Bitt, they have tested DCash across its eight member island countries since 2021. For additional information, please visit.

Sweden’s Riksbank

Riksbank has been actively exploring the concept of a CBDC through their e-Krona initiative. The e-Krona project is an effort by Sweden’s central bank to comprehend and assess how the general public could use a digital version of their national currency. This has involved a comprehensive pilot testing phase, during which they used a blockchain solution developed in partnership with Accenture.

The main goal of the e-Krona initiative is to address the ongoing decline in cash usage within the country. By providing a digital alternative, the Riksbank hopes to ensure that the public continues to have access to a state-guaranteed means of payment, thus preserving financial stability in a rapidly digitizing economy. More at here.

The Bahamas — The Sand Dollar

Emerged as the world’s first fully implemented digital fiat currency. Its primary function is to streamline the costs associated with delivering these services and to optimize the efficiency of transactions to ensure a seamless experience for users.

The Sand Dollar operates on a distributed ledger platform, specifically designed for the project, not only to support the operations of the digital currency but also to strengthen the overall financial infrastructure of the Bahamas. More information here.

Project Hamilton — US

There are several ongoing projects in the US according to the CBDC Tracker, but one to highlight is Project Hamilton. This collaborative research endeavor between the Federal Reserve Bank of Boston and MIT’s Digital Currency Initiative explores the technical aspects of a potential US CBDC. Rather than simply brainstorming, this multi-year project involves tangible exploration into the CBDC landscape, examining the technical challenges and opportunities that digital currency design presents.

The project’s “FooWire” experiment, which uses Hyperledger Fabric, has demonstrated the potential of DLT for payment systems. It has highlighted rapid development capabilities and robust performance under test conditions. It is important to note that Project Hamilton does not favor any particular technology. The project’s findings do not indicate any immediate decisions or endorsements of specific technologies for a future digital dollar.

But thinking “outside the box”, Circle’s USDC could evolve into a de facto CBDC, which is an intriguing concept. USDC, as a dollar-pegged stablecoin, already offers a preview of a digitized dollar’s functions. However, USDC is a private venture, separate from the sovereign digital currency that a CBDC would be. While transforming USDC into an official CBDC might not be as complex as it appears, it would require extensive regulatory navigation and policy development to meet the Federal Reserve’s standards and objectives.

You can access the resources below for more information about it:

Project Hamilton Phase 1 Executive Summary — Federal Reserve Bank of Boston

Boston Fed, MIT complete research project into feasibility of a central bank digital currency

My preferred initiative after DREX (of course)…

The Reserve Bank of Australia (RBA)

Also known as “Project Atom,” which was undertaken in 2020–2021. This project, in collaboration with the Commonwealth Bank of Australia, National Australia Bank, Perpetual, and ConsenSys (among others), was aimed at examining the potential use and implications of a CBDC for digital finance innovation.

Additionally, the RBA, together with the Digital Finance Cooperative Research Centre (DFCRC), released a white paper detailing a joint research project to explore use cases for a CBDC in Australia. This project invited industry engagement and aimed to assess the benefits and risks of a digital Australian dollar.

A recent media release from the RBA indicates that they have completed a research project involving industry that explored potential use cases for a CBDC in Australia. Additionally, a news article from the Financial Review suggests that the launch of an eAUD is considered to be “some years away”, indicating that while exploration and research have been conducted, a decision to create an eAUD is not imminent.

For more information, here are some sources:

World Economic Forum’s CBDC Technology Considerations (from 2021, but worth reading)

Atlantic Council’s report on CBDC evolution in 2023

World Economic Forum’s Global Interoperability Principles for CBDCs

IMF’s guide on CBDC Development

Important reminder

Every blockchain is a DLT, but not every DLT is a blockchain. Getting this difference is super important if you want to get the big picture of distributed systems.

A blockchain is a subset of DLTs. It is characterized by its chain of blocks, which contain transaction data that is cryptographically linked and secured.

So, DLT is like the big umbrella, right? It covers a whole bunch of ledger technologies. They spread info across different nodes or places, but they don’t always line up in a neat little blockchain chain. These other DLT systems might use different ways to record transactions and get everyone to agree, which means they can offer different features that work best for specific situations.

You can Google more about it, or here is a good piece to read.

The technical landscape

Blockchain and DLT are all the rage these days, especially when it comes to CBDCs. It is a wild and ever-changing world out there, with a ton of new developments popping up left and right. It can be a bit much to keep track of, I know. So, I’m gonna do my best to give you a clear and current rundown of the tech stuff that is going on with CBDCs. This includes the tech that is being tested or used in CBDC trials and projects around the world. Let’s dive in and see how things are shaping up.

Hyperledger Fabric

The one that has been utilized in Project Hamilton by the prestigious Federal Reserve Bank of Boston in collaboration with the Massachusetts Institute of Technology (MIT). It is a permissioned blockchain framework. It is well-recognized and highly regarded for its modularity, a characteristic that makes it an adaptable solution for various needs. Alongside this, it also stands out due to its versatility, making it an ideal choice for enterprise applications where diverse and often complex requirements need to be met.

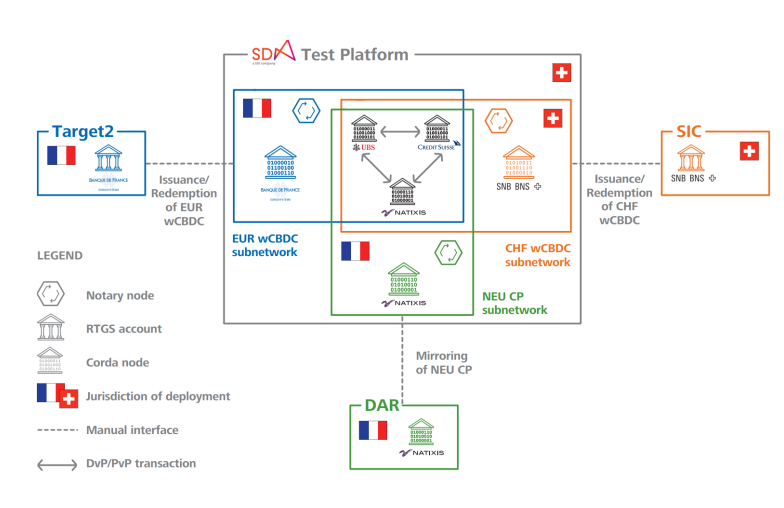

R3’s Corda

France used Corda in their wholesale CBDC experiments. Corda focuses on privacy, scalability, and interoperability, tailored for regulated financial markets. The United Arab Emirates (UAE) also uses Corda for their CBDC initiatives. The Central Bank of the UAE (CBUAE) chose R3, G42 Cloud, and Clifford Chance to help implement their CBDC strategy. This is part of the UAE’s digital transformation efforts. Corda’s strengths likely contributed to its selection.

R3’s involvement suggests the UAE plans a complex infrastructure for their digital currency. It could serve retail and wholesale applications. Corda’s ability to manage secure, peer-to-peer transactions and meet central banks’ capital and liquidity needs makes it a good fit for countries like the UAE. They aim to use CBDCs to improve their financial systems. — More about it here.

Project Stella

It is a collaborative research initiative between the European Central Bank (ECB) and the Bank of Japan (BoJ). It has been focused on exploring the potential applications of DLT in financial market infrastructure. The project has released multiple reports detailing its findings across different phases.

One of the key objectives of Project Stella has been to investigate how DLT can enhance the efficiency and security of large-scale payment systems, which are integral to the functioning of the global financial system. The research has addressed various aspects including, but not limited to, the balance between confidentiality and “auditability” in a DLT environment, liquidity saving mechanisms, and the feasibility of synchronized cross-border payments.

The Swiss “Helvetia” project

This collaboration between the Swiss National Bank (SNB) and SIX Digital Exchange (SDX) wants to explore the integration of DLT-based assets with the Swiss Interbank Clearing System. I could not find the specifics of the tech they are using, so if you know about it, leave the information in the comments.

The project’s goal is to evaluate the settlement of tokenized assets and the integration of a wholesale Central Bank Digital Currency (wCBDC) into the existing financial infrastructure. Phase II included commercial banks and featured end-to-end transactions using wCBDC, integrating them into the core banking systems of both the central and commercial banks.

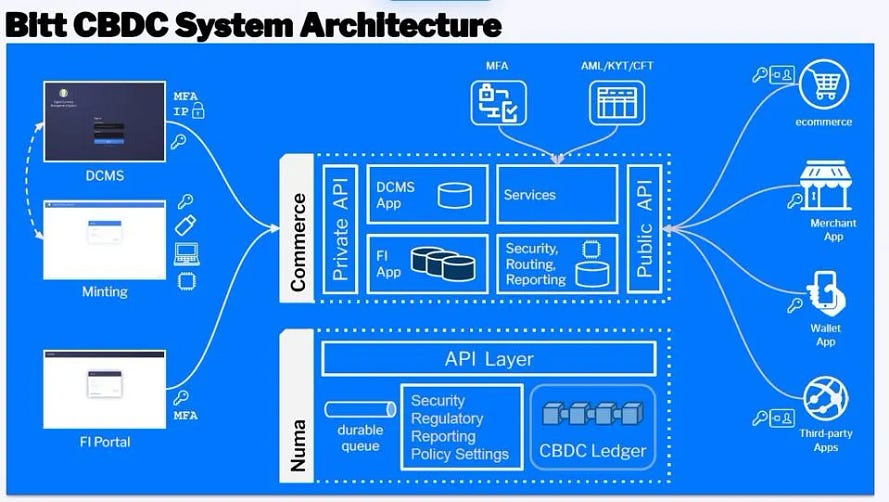

Bitt Inc.’s Blockchain Platform

As the case of Eastern Caribbean Central Bank’s DCash is powered by Bitt Inc.’s blockchain platform, I thought it would be interesting to mention them.

Bitt Inc. is a solution developer for CBDCs and stablecoins. I did not find any detailed technical specifications, so it appears to me to be one of those “black boxes” about which one can not learn much publicly. But following is some information I’ve found.

Ethereum-Based Platforms (EVMs)

Some projects, like the Reserve Bank of Australia’s eAUD pilot, have considered Ethereum-based solutions for their CBDC. So like DREX, with its Hyperledger Besu, among others. The good part of EVMs is that they are open source and can be used for custom-builts’ like Brazilian startup Parfin’s Parchain solution, a private ledger architecture using a Geth core with steroids and Zero Knowledge Proofs (ZKPs) + Homomorphic encryption to connect the Commit chain, which can be any open source EVM like Besu. We will see more about Parchain later in this article.

SDX (SIX Digital Exchange)

The Swiss National Bank, which is kind of a big deal in the finance world, has been messing around with a major test on a wCBDC. And they have been doing it alongside Swiss Digital Exchange (SDX). Yeah, SDX is this super cool digital exchange platform that is all about trading, settling, and looking after digital assets.

In my opinion, it is really pushing the boundaries of managing digital assets. And you have got to admit, it is pretty epic that the Swiss National Bank is testing a wholesale CBDC on SDX. It is a game-changer for digital currencies. And let’s be real, SDX is a project to keep an eye on. It’s got the potential to flip the script on how we handle and swap digital assets in the future.

Quorum

J.P. Morgan originally developed the platform, which ConsenSys, a blockchain software technology company, later acquired.

Quorum is known for its Ethereum-based features, which include smart contract functionality within a private blockchain setting. These characteristics are appealing for the development of CBDCs because they offer a balance between the innovation of Ethereum’s decentralized ledger technology and the privacy and control required by central banks for digital currency issuance and management.

The advantages of using a platform like Quorum for CBDCs may include, enhanced privacy features suitable for financial transactions where sensitive data is involved, the ability to process a large number of transactions, which is essential for national payment systems, the capability to interact with other blockchain systems and traditional banking infrastructure and robust security protocols to protect against fraud and cyber threats. But it’s the same as any other EVM system.

Stellar

Several projects have evaluated the potential of incorporating Stellar into their frameworks. This is primarily because Stellar has been specifically designed with a focus on enabling cross-border transactions. This design allows it to facilitate quick transfers, a feature that is especially beneficial in today’s fast-paced world where speed is of the essence.

Additionally, Stellar prides itself on its ability to execute these transfers at a significantly lower cost compared to traditional systems. This cost-effectiveness, combined with its efficiency, makes Stellar an attractive option for these projects.

Algorand

Known for its speed and efficiency, has become a topic of conversation when considering potential options for CBDCs. This is mainly due to its scalability and robust security features. Its ability to handle a high volume of transactions simultaneously, without compromising on the speed or efficiency of the process, makes it an attractive option. Additionally, Algorand’s robust security measures ensure that the integrity and safety of transactions are maintained, which is a critical aspect for any CBDC platform.

All these technologies illustrate the experimentation with various platforms based on specific needs, regulatory environments, and policy goals of different central banks. Thanks to the internet, it’s very easy today to study and learn a lot about all of this.

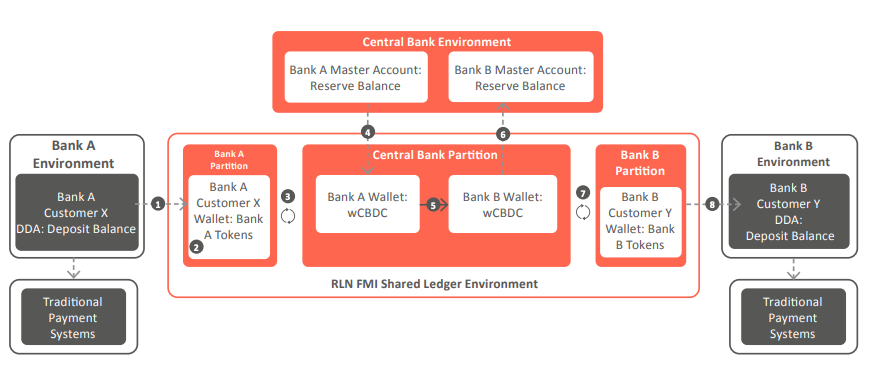

RLN’s — Regulated Liability Networks

Sovereign currencies are what we call “regulated liabilities”. They essentially consist of promises made by regulated institutions that they will pay you on demand at face value in national currency units. The whole aim of financial regulation is to make sure you get your money’s worth, maximizing your chances of redemption — The Central Bank liability.

The RLN concept examines how a regulated Financial Market Infrastructure could create a network that includes all aspects of the sovereign currency system: CBDCs, commercial bank money or their own “stablecoins”, and cryptocurrencies (and potentially, regulated stablecoins in the future like Circle’s USDC). This concept investigates the intersection of shared ledger technology and the sovereign currency system. If blockchain can improve financial services, then it should be used in regulated financial services — that’s RLN’s idea.

Basically, it’s a design for digital sovereign currency that is not limited to central bank liabilities.

RLNs might be a cool way for regulated markets to jump into a global network of tokenized regulated liabilities. Sure, these liabilities are kicking around today and get traded through all sorts of methods, but RLNs bring something new to the table:

- All of the company’s liabilities, including short-term debts, long-term debts, and other financial obligations, are recorded and carefully tracked on a comprehensive, single network. This ensures that all necessary financial information is readily available, enabling the company to make informed decisions about its financial health and stability.

- The network will have the responsibility of maintaining balances. This involves keeping ledgers that record the identities of issuers and holders. The purpose of these ledgers is to ensure transparency and accuracy in transactions. They will provide an important function in tracking the movement of assets, thereby helping to prevent any possible disputes or misunderstandings.

- Participants can access their balances using wallet systems. This wallet system provides a streamlined, user-friendly platform where participants can easily monitor and manage their balances, ensuring optimal transparency and control.

- A system is used to leverage the mapping of participant ledgers. This system can be designed to atomically update the balances of two or more participants simultaneously. This approach ensures the settlement of payments is done efficiently and securely, thereby maintaining the integrity and accuracy of each transaction. This method of updating and settling payments is an essential part of our system, ensuring smooth and reliable transactions for all end-users. The RLN is programmable, so the atomic update of all ledgers must occur in real-time.

SETL provides a strong framework for managing assets and liabilities in regulated environments. Their RLN solution combines security, transparency, and speed, enabling real-time transactions that meet regulatory standards. It’s designed to establish new standards of trust and reliability in the digital era.

SETL is involved in the DREX pilot alongside Banco Bradesco and Núclea, and has collaborated with SWIFT on a pilot for a universal tokenization framework. This project was all about making digital asset tokenization a standard, by making global financial transactions more efficient and interoperable. Plus, it was designed to make the process of issuing and transferring tokens a breeze, which could lead to more liquidity and even stronger financial markets.

Want to know more? You can find all the details online. Stay curious!

Custom-built systems

China’s e-CNY represents a specifically designed system for a CBDC. The People’s Bank of China has been working on this digital currency since 2014, with the objective of providing a state-supported digital currency that offers a range of management possibilities for its extensive financial system. Instead of being based on a public blockchain system, it utilizes a bespoke infrastructure that enables the PBoC to maintain control over the currency’s distribution and circulation. It’s unlikely that China would rely on a Western Blockchain provider.

But what is a bespoke infrastructure?

CBDCs are like your own personal digital currencies, whipped up with a country’s central bank’s special needs in mind. This isn’t your run-of-the-mill stuff, but a custom-built setup designed to tick all the right boxes. So, what is in this tailor-made package for CBDCs? Let’s try to break it down:

Customization — We’re talking about a system built with all things country-specific in mind — the financial scene, legal stuff, economic targets, tech landscape, and the must-haves for your CBDC.

Control — With a custom setup, central banks get the reins — they get to call the shots on the currency’s issuance, distribution, regulation, transaction monitoring, privacy handling, and compliance.

Integration — These tailor-made systems can mingle with the existing financial setups like a charm — think interbank payment systems and ATM systems.

Security and Scalability — Custom-built means addressing the exact security threats and scalability needs, ensuring transactions are safe and smooth.

Sovereignty — With your own digital currency system, a country can keep its monetary policies independent, free from any external influences.

With custom infrastructures, you can get innovative stuff like next-level consensus algorithms and unique digital wallet designs, hitting the bullseye of what the central bank wants to achieve.

Alright, there’s always a “but” coming after another “but”, right?

So here are some things we’ve gotta think about:

Complexity and Cost — Custom-built systems can be a real headache to design, and they do not come cheap. They need a good chunk of cash for research, development, and testing to make sure they match the unique needs of any country’s financial system.

Maintenance and Upgrades — A tailor-made system might need constant care and feeding, which can be a bit of a drain on resources. Plus, there’s the risk of it becoming old news if it can’t keep up with the latest tech or changes in monetary policy.

Interoperability Challenges — While a custom-built system can fit in nicely with a country’s existing financial infrastructure, it might have trouble playing nice with international systems or other CBDCs. This could lead to hiccups with cross-border transactions.

Security Risks — Even though they are designed to deal with specific security threats, custom systems might have their own unique weak spots. As they’re new and untested on a large scale, there could be security gaps we have not even thought of that could be exploited.

Adoption Barriers — Tailor-made systems might not be instantly loved by users and financial institutions because they are not familiar, or they need some type of special training and support.

Scalability Concerns — Even though they’re designed to grow, the only way to really know how they will perform under pressure is over time. There is a chance the system might not grow as expected when lots of people start using it or during peak demand.

Dependence on Vendors — If the development work for the bespoke system is outsourced, you are relying on the vendor for updates, security, and tech support. This could be risky if things go south with the vendor or if they go out of business.

Regulatory Compliance — As rules and regulations change, especially in response to new tech and financial tools, the custom system has to be flexible enough to adapt to these changes without needing a total makeover.

Testing Limitations — Early-stage experiments might not show us the full picture of what a live financial environment looks like, which could lead to problems when the system is launched on a large scale.

Technological Uncertainty — Given that DLT and blockchain technologies are the new kids on the block and are changing fast, there’s some uncertainty about how they will hold up in the long run.

These potential problems underscore the need for careful planning, solid design, thorough testing, and ongoing evaluation as countries explore and build their own CBDC systems. I personally believe that a “collab” between the government, development companies, and solution vendors is the best approach for now. Not full speed on black boxes, but adding some “personal touch” when it is possible to improve something that already exists.

I would like to learn more about these custom-built DLTs, so if you have information, please share it in the comments.

These instances highlight that while some countries are leveraging existing blockchain or DLT platforms for their CBDCs, others are opting for custom-built infrastructures that are more closely aligned with their unique regulatory, economic, and operational requirements.

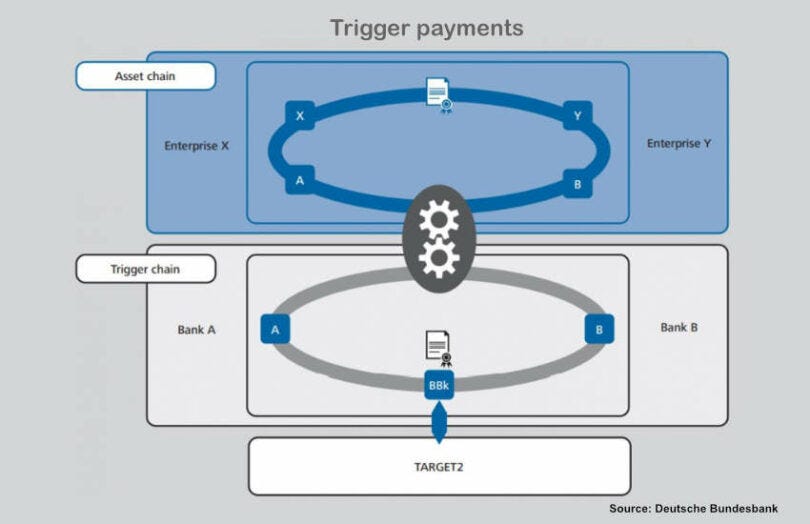

Trigger solution: Bundesbank case

Recently, I have bumped into an interesting article about the Deutsche Bundesbank, doing some tests on something called a “trigger solution”. Thanks Harvey Li for sharing it.

This solution is all about settling securities transactions that are based on a DLT, using a CBDC. Basically, it connects the securities DLT and Europe’s TARGET2 system, the real-time gross settlement (RTGS) system. RTGS is super efficient with high-value euro transactions and what Bundesbank is doing could be an alternative to a wCBDC.

But could this apply to the DREX?

Considering possible next steps for the Brazilian DREX CBDC pilot, one potential option that could be explored is the implementation of a trigger solution. This could be a fit for a project’s second phase, maybe if looking at cross-border transactions.

But let’s analyze below some steps on how this solution could potentially work.

PIX and STR integration

The trigger solution could be integrated with the existing real-time payment systems currently in use in Brazil. These systems include Pix, our highly efficient Instant Payment System, and the Reserve Transfer System, known as STR (Sistema de Transferência de Reservas). These two systems serve as the backbone of Brazil’s financial transactions, and integrating the trigger solution into these systems could greatly enhance their functionality and efficiency.

DLT Asset Chain

Transactions involving securities or other financial assets would be recorded on a DLT-based asset chain, similar to what enterprises use in the Bundesbank’s proposed system.

Trigger Chain

Only commercial banks and the BCB would use a programmable trigger chain. When a securities transaction is completed on the DLT asset chain, a corresponding payment instruction is created on the trigger chain.

Payment Execution

The instruction on the trigger chain would initiate a payment in the Brazilian RTGS system, like the STR, using a CBDC. This ensures that money remains within established systems and under the control of the Central Bank.

This approach would allow the Central Bank of Brazil to maintain a high degree of control and oversight over financial transactions while leveraging some of the advantages of DLT technology, such as programmability. However, it would need to be assessed whether this solution aligns with the strategic objectives of the Central Bank for Drex and whether it can be integrated with existing infrastructure and Brazilian financial regulations.

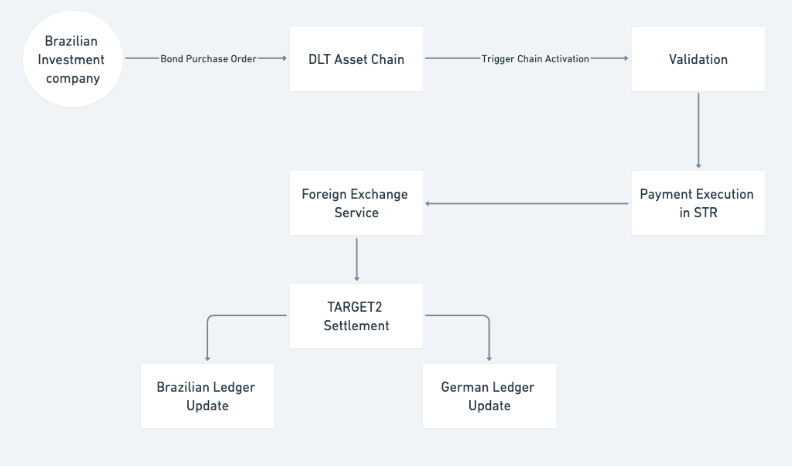

Use case exploration

Imagine a situation where a Brazilian investment company wants to buy government bonds from Germany. Traditionally, this international transaction would involve many intermediaries and currency conversion. It could also take several days to complete, with each step potentially introducing delays and additional costs. With this trigger solution integrated into the Drex CBDC system, it could work like this:

- The Brazilian firm uses the DREX platform to initiate the purchase of German bonds.

- The details of the bond purchase are recorded on a DLT-based Asset Chain, which is designed to handle securities transactions.

- Once the transaction is validated on the Asset Chain, a trigger is sent to the trigger chain, which is exclusively accessed by the BCB and commercial banks.

- The trigger chain sends an instruction to Brazil’s RTGS system (STR) to release the equivalent amount of Brazilian Reais (BRL) in CBDC form to be exchanged for the German bonds.

- Foreign Exchange and Settlement: The BRL is exchanged for Euros (EUR) through a foreign exchange service that is also integrated with the trigger solution. The Euros are then transferred to the German seller’s bank using a corresponding system like TARGET2 (the Eurozone’s RTGS).

- Confirmation and Reconciliation: Once the payment is confirmed, both the Brazilian buyer and the German seller have their respective ledgers updated to reflect the sale and purchase of bonds, with no need for manual reconciliation since the transaction is recorded on a shared DLT platform.

This use case demonstrates how a trigger solution could simplify cross-border securities transactions by automating processes. It could also reduce settlement times and lower transaction costs by minimizing the need for intermediaries. Additionally, it highlights the increased efficiency in financial operations that integration of a CBDC with Distributed Ledger Technology can bring, while still maintaining the security and oversight provided by central banks.

It’s worth watching a underdog closely — Hathor

I do not want to divorce from reality but as we are exploring “options”, why shouldn’t we check some possibilities with some other chains?

Hathor is a digital platform for financial transactions and contracts with a unique combination of high scalability and high decentralization. It creates the perfect environment for multiple use cases where scale, efficiency, long-term security, and censorship-resistance through network distribution combined are needed or can drastically cut current costs and bureaucracy.

What makes Hathor different

Their source-code was created from scratch in Python by a team of highly-skilled developers, some of whom have been researching cryptocurrencies since 2011. A novel distributed ledger architecture using both DAG and blockchain data structures intertwined. Highly scalable with no central coordinator or single point of failure. Fee-less, quick transactions and Proof of Work mining rewards economically incentivizes the network forever, with a perpetual and low emission of native HTR tokens.

Besides doing their usual stuff, the company has also dipped its toes into the whole cryptocurrency scene. They have managed to team up their mining operations with two of the big shots in the crypto world: bitcoin and litecoin. This clever move not just gives them more options in their portfolio, but also puts them smack in the middle of the fast-growing digital currency market.

You can create your own digital token with customized specifications on Hathor Network with only a few clicks or use Nano-contracts (their Smart contracts version) for a more secure and straight-to-the-point vision for embedded smart contracting capabilities. Created under heavy scientific and academic scrutiny, originally a research paper written by cofounder Marcelo Brogliato and published as part of his Ph.D. thesis.

Hathor is indeed a very interesting project to watch. I highly recommend it if you are just starting with Blockchain. They’ve also recently been working on Bridge to EVM blockchains, which could grow this project very quickly. For more information, you can look at their website or straight to their Executive Summary.

DLTs have disadvantages and challenges as there is no perfect solution for anything (yet)

So, you want to know about some things to remember when you are bringing blockchain or DLT into play in the world of finance and regulated markets? Here they are:

Complexity

Implementing a DLT/blockchain solution can be complex, requiring specialized knowledge and understanding of the technology, which are scarce at the moment, which can lead to a steep learning curve for the institutions involved. So, my choice is always to look for partners that have a proven track record of their expertise and intellectual capacity.

Integration challenges

Integrating EVMs or other systems with existing legacy financial services and regulatory frameworks can be difficult, as it requires adapting these legacy systems to work with new blockchain-based processes. Privacy is a big issue. Cyber security too.

Performance and throughput

Transaction throughput, when compared to traditional centralized payment systems, especially at scale, is significant. Multiple vendors and solutions claim a high TPS (transactions per second) capability, but we have not evolved to a volume level that really pushes them to their limits. Yeah, there are tests. But “testing” the spaceship to land in the moon and actually land in the moon are very different things.

Adoption

In order for CBDCs to be successful, the general public and financial institutions must adopt them widely. Unfamiliarity with blockchain technology could hinder adoption rates. Internal corporate education about this technology at all levels is extremely important, especially for the older, traditional IT folks. Personally, I think the UX is a huge challenge. For the enduser, we don’t need to force a technical education to show the benefits. Most of us use digital services today and have no idea how they work behind the scenes. Show the benefits, and they will be useful.

Regulatory uncertainty

Blockchain technology is still a relatively new field and regulatory frameworks around it are evolving. This could pose risks related to compliance and legal recognition of transactions performed by most existing solutions. Countries like the US are struggling, and places like Brazil; are far ahead on this topic.

Security concern

Even with robust security measures, blockchain networks could still face unexpected vulnerabilities or attacks. Given the critical role of CBDCs, the impact of such incidents could be substantial.

Cost

The development, deployment, and maintenance of a blockchain infrastructure can be costly. This includes ongoing costs associated with updates, security measures, and potential scalability improvements. Cloud services are also expensive, so make sure to consider them in your business cases.

Energy consumption

Depending on the consensus mechanism used, blockchain networks can consume significant amounts of energy, although permissioned networks might mitigate this compared to public blockchains like Ethereum.

Vendor lock-in

Dependence on vendors for updates, support, and maintenance could lead to vendor lock-in, making it difficult to switch providers or adopt new technologies in the future. Open-source components are extremely important to consider. There are several “proprietary” solutions that create more flexible ways and even offer “free versions” of their products.

Interoperability with other blockchains

While most of them, especially EVM solutions, are designed to be interoperable, in practice, seamless interaction with other blockchains can be challenging and might require additional layers, protocols, and bridges, bringing additional risks to the game.

As we conclude this exploration of the fascinating world of Central Bank Digital Currencies, especially focusing on the specific case of Brazil’s innovative DREX initiative, we are at a crucial point in the ongoing development of global finance.

Looking at Drex’s development from concept to pilot phases shows the potential of CBDCs. They can improve financial transactions, increase financial inclusion, and boost economic efficiency beyond traditional currencies. However, this process isn’t easy. It involves overcoming technical issues, addressing regulatory concerns, and gaining trust from diverse citizens and institutions.

Looking at the worldwide digital (or programmable) money scene, we see a wide spectrum, where each country is creating its own way to digitize its financial systems. The facts and stories shared in this series, especially Brazil’s work with the DREX initiative, give us important lessons.

We learn about the good and bad points of using CBDCs. This is very important for many people, like policymakers, tech innovators, and financial leaders. They can use this to understand the complex world of digital finance.

Looking ahead to the future, it is evident that the success of CBDCs will largely depend on a combination of careful design, implementation of robust security measures, and the establishment of transparent governance structures. Equally significant will be the capacity of these digital currencies to interoperate within a global financial system that is itself undergoing a period of significant flux.

The process of exploring digital money and CBDCs transcends the boundaries of a mere technological or financial endeavor; it’s a journey towards reimagining how value is exchanged in an increasingly digital age. Moving forward, the knowledge gained from innovative projects like DREX will be important in creating a financial ecosystem that is more inclusive, efficient, and ready for future challenges.

Alright, so wrapping this up, even though we’re stepping into some pretty unclear waters and there are lots of challenges ahead, the potential of CBDCs like DREX to totally flip the script on our financial systems is super exciting, right? If we continue to innovate, work well together, and maintain open communication, we can successfully navigate this new territory. Our goal is a future where digital currency creates opportunities and makes finance fair for everyone.

Special thanks

Collaboration is crucial in this market. I would like to express my special thanks to Robson Junior (Pods Finance) and Caroline Nunes (InspireIP/Infratoken) for their reviews, corrections, and insights.

Your thoughts really matter in this chat we’re having. Let’s keep shaping the future of finance together, shall we? Hope you enjoyed. Feel free to reach me on Linkedin.

*Leandro Pereira (Sciammarella) is Blockchain Head at Núclea.

This article was originally published at Leandro Pereira’s profile at Medium